Healthcare Policy Watch: CVS Deepens Vertical Integration with $10.6B Oak Street Health Acquisition

- Nov 17, 2025

- 2 min read

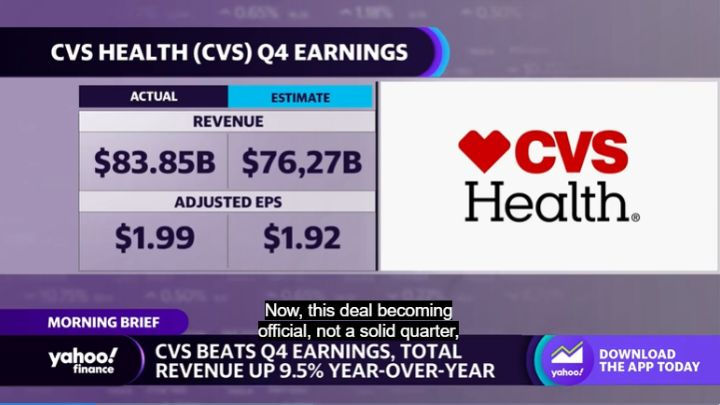

The structure of American healthcare is undergoing a radical transformation, and few moves illustrate this shift better than CVS Health's substantial acquisition of Oak Street Health. Completed in early 2023, the transaction, valued at around $10.6 billion, solidifies CVS’s aggressive pursuit of vertical integration in the primary care space.

This deal is less about simple growth and more about strategic realignment around the philosophy of value-based care. This model represents a fundamental departure from traditional volume-based services, emphasizing the improvement of patient outcomes over the sheer quantity of medical services delivered. By bringing Oak Street’s operations under its umbrella, CVS is positioning itself to not only improve overall healthcare outcomes but also to reduce systemic costs, with a specific focus on extending better care to underserved communities.

CVS’s expansive infrastructure plays a crucial role in this strategy. The company intends to significantly expand the presence of Oak Street’s existing clinics and leverage its substantial retail and pharmacy channels. This integration is designed to enhance overall patient care and adherence to treatment plans, making the path from prescription to primary care consultation more seamless for patients. Notably, CVS financed part of this colossal $10.6 billion deal through borrowing.

The integration of such a large primary care provider, however, carries significant operational and policy implications. The movement towards vertical integration and ownership of care facilities necessitates a "reworking of existing contracts with insurers and providers". This type of complex contractual restructuring is not unique to CVS; the sources note that this move aligns with broader industry trends, referencing similar efforts by UnitedHealth regarding its Optum contracts.

Despite becoming an owner of care facilities, CVS is attempting a delicate balancing act. It seeks to maintain neutrality regarding reimbursements. This neutrality is crucial for ensuring that the newly integrated system can function efficiently without alienating other insurers or providers who might rely on CVS’s pharmacy and PBM services.

The $10.6 billion investment in Oak Street Health underscores a critical industry observation: the future of major healthcare companies lies in building comprehensive, coordinated care systems. CVS is no longer just a retailer or an insurer; it is rapidly evolving into an expansive and highly integrated provider network, aiming to control every step of the patient journey from wellness checks to treatment adherence, driven by the guiding principle of value-based care.

This vertical integration—combining the payer, the provider, and the pharmacy—is akin to a supply chain restructuring where the manufacturer (the care provider) and the distributor (the insurance/pharmacy channel) merge. The goal is efficiency and cost reduction, but it fundamentally changes how products (healthcare services) are priced and delivered across the system.

🔖 Sources

Keywords: Oak Street Health

Comments