Incyte Corporation (INCY) Stock: A Biotech Leader at a Deep Value Inflection Point

- Sep 23, 2025

- 7 min read

In the volatile world of biotechnology, Incyte Corporation has carved out a rare and valuable niche. It is a company that successfully transitioned from a speculative R&D outfit into a consistently profitable, commercial-stage biopharmaceutical leader. This success was built on the back of a single, revolutionary drug: Jakafi, a first-in-class treatment for rare blood cancers that became the foundation of the entire company.

For years, the steady, blockbuster sales from Jakafi funded a deep and diverse R&D pipeline, while its commercial success proved that Incyte could stand on its own as a fully integrated biopharma company. However, the market’s focus has now shifted. With the patents on its foundational drug set to expire at the end of the decade, and a string of late-stage clinical trial disappointments, Incyte’s stock has fallen to multi-year lows.

This has created a stark and compelling dilemma for investors. Is Incyte a classic value trap, a company facing the inevitable decline of its flagship product with an unproven pipeline to back it up? Or is it a deeply undervalued, scientifically-driven powerhouse with a diverse set of growth drivers that the market is completely overlooking? This in-depth analysis will dissect the investment case for Incyte.

A Legacy of Kinase Expertise

Incyte was founded in 1991, initially focused on genomics research. However, the company's modern identity was forged in the early 2000s when it pivoted its strategy to focus on the discovery and development of small molecule drugs, particularly in a class of enzymes known as kinases.

Kinases are critical signaling proteins within cells, and when they malfunction, they can be a key driver of cancer and inflammatory diseases. Incyte’s scientific founders believed that by developing highly specific "kinase inhibitors," they could create a new generation of targeted therapies.

This deep scientific focus paid off in spectacular fashion. The company’s research led to the discovery of ruxolitinib, a novel JAK1/JAK2 inhibitor. This breakthrough compound became the foundation of its first and most important commercial product:

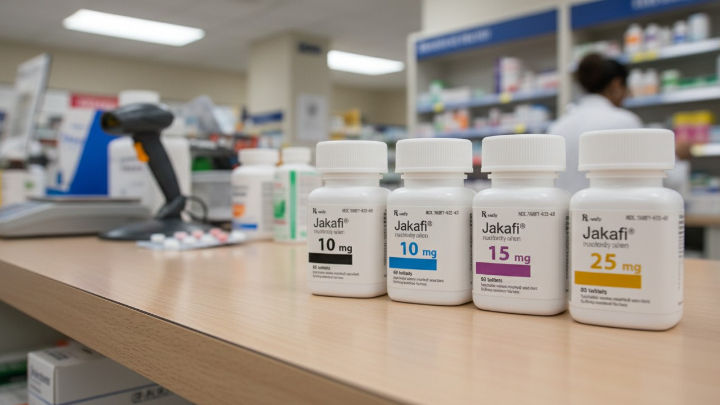

Jakafi (ruxolitinib): Launched in 2011, Jakafi was the first-ever FDA-approved treatment for myelofibrosis, a rare and serious type of bone marrow cancer. It was a true medical breakthrough, providing the first effective therapy for a patient population with no other options. The drug's approval was later expanded to include polycythemia vera, another rare blood cancer.

The success of Jakafi was transformative. It turned Incyte from a cash-burning R&D company into a highly profitable, commercial-stage enterprise. The massive and growing cash flow from Jakafi has funded the entire expansion of the company for the past decade.

The Modern Incyte (INCY): Diversifying Beyond Jakafi

Today, Incyte’s business is best understood as three distinct pillars: the foundational Jakafi franchise, a growing portfolio of commercial-stage products, and a deep, if risky, R&D pipeline.

1. The Jakafi Franchise: The Profitable Foundation

Jakafi remains the heart of Incyte. It is a highly profitable blockbuster drug that is expected to generate over $2.7 billion in revenue in 2025. It is the undisputed standard of care in its approved indications and provides the stable, predictable cash flow that gives the company its financial strength. However, the key U.S. patents for Jakafi are set to expire around 2028, creating the "patent cliff" that is the source of the market’s anxiety.

2. The Diversified Growth Portfolio

Incyte’s entire strategy for the past decade has been to use the cash from Jakafi to build a diversified portfolio of new products to drive growth after Jakafi’s patents expire. The success of this effort is the key to the bull case. The key approved products in this portfolio include:

Opzelura (ruxolitinib cream): This is the company's most important new product and its biggest potential growth driver. Opzelura is a topical cream formulation of the same drug that is in Jakafi. It is the first and only FDA-approved topical JAK inhibitor, approved for treating atopic dermatitis (eczema) and, more importantly, nonsegmental vitiligo, a chronic autoimmune disease that causes skin depigmentation. The vitiligo market is massive and almost entirely untapped, making the Opzelura launch one of the most important in the company’s history.

Royalty Revenue (Jakavi & Olumiant): Incyte receives significant, high-margin royalty revenue from its large pharma partners. Novartis markets ruxolitinib outside the U.S. under the brand name Jakavi. Eli Lilly markets another of Incyte’s discovered compounds, baricitinib, as Olumiant for rheumatoid arthritis.

Oncology Portfolio: The company has a growing portfolio of approved cancer drugs, including Monjuvi for lymphoma and Zynyz for a rare type of skin cancer.

3. The R&D Pipeline: The Key to the Future

The ultimate long-term success of Incyte will be determined by the productivity of its R&D pipeline. The company is leveraging its expertise in kinase biology and other areas to advance a deep pipeline of new drug candidates. Key areas of focus include:

Oncology: Advancing a new generation of targeted therapies and immunotherapies.

Dermatology: Expanding the potential uses of Opzelura and developing new topical and oral treatments for inflammatory skin conditions.

Inflammation: Developing new therapies for a range of autoimmune diseases.

However, the pipeline has also been a source of frustration for investors, with a number of high-profile, late-stage clinical trial failures in recent years that have contributed to the stock's poor performance.

Financials: A Deep Value Profile

Incyte’s financial profile is a picture of a mature, highly profitable company that the market has priced for a pessimistic future.

High Profitability and Strong Cash Flow: Thanks to the high-margin sales of Jakafi, Incyte is a very profitable company that generates strong and consistent free cash flow.

Pristine Balance Sheet: The company has a fortress balance sheet with a massive net cash position (often exceeding $4 billion) and no debt. This gives it immense financial flexibility to fund its pipeline and to pursue strategic, "bolt-on" acquisitions.

Capital Allocation: The company has a shareholder-friendly capital allocation strategy, primarily focused on using its free cash flow to aggressively buy back its own stock. While it does not pay a dividend, its share repurchase program has significantly reduced its share count over time.

Deeply Depressed Valuation: This is the key attraction for value investors. Due to the concerns about the Jakafi patent cliff and recent pipeline setbacks, INCY stock is trading at a very low forward P/E ratio, often in the low double-digits. This is a massive discount to the broader market and to the biotech sector average.

The Investment Thesis: Weighing the Pros and Cons

When analyzing Incyte, the investment case presents a classic battle between a deeply discounted valuation and the significant risks of a concentrated business model facing a major patent cliff.

The Bull Case: Why Invest in Incyte?

The primary argument for investing in Incyte today is its deep value valuation. The stock trades at a rock-bottom P/E ratio, suggesting the market has already priced in a worst-case scenario for the upcoming patent expiration of its foundational drug, Jakafi. This low entry point provides a significant margin of safety. The bull case is further supported by the major growth potential of Opzelura, a topical cream that is just beginning to penetrate the massive and largely untapped vitiligo market and could become a multi-billion-dollar blockbuster on its own. The company is a highly profitable and cash-generative business with a fortress balance sheet and a massive net cash position. It is using this financial strength to fund an aggressive share buyback program, which should be highly accretive to earnings per share at the stock's currently depressed levels.

The Bear Case: Reasons for Caution

Conversely, the reasons for caution are significant and clear. The entire investment story is dominated by the Jakafi patent cliff, as the company’s foundational drug, which accounts for the majority of its profits, faces a loss of exclusivity at the end of the decade. This risk is amplified by a series of recent pipeline setbacks, where high-profile, late-stage clinical trials have failed, damaging investor confidence in the company’s ability to develop the next wave of products needed to replace Jakafi's revenue. As a biotech, the company's future is entirely dependent on its pipeline, which carries high R&D risk. Furthermore, it faces intense competition in its key markets of oncology and inflammation from much larger pharmaceutical companies. Finally, the company’s focus on reinvesting and buybacks means it pays no dividend, making it unsuitable for income-focused investors.

Fundamental Data

Go beyond the stock price with this deep dive into a company's core fundamentals.

🔖 Key Takeaways

The decision to invest in Incyte today is a classic deep-value, contrarian bet on a scientifically-driven company. It is an investment that requires a belief that the market has become overly pessimistic and is ignoring the significant growth potential of the company's non-Jakafi assets.

For the Deep-Value, Contrarian Investor: Incyte is one of the most compelling opportunities in the entire biotech sector. The investment thesis is that you are buying a highly profitable, cash-rich company with a pristine balance sheet at a single-digit P/E ratio (ex-cash). The market is pricing the company as if Jakafi will go to zero and the pipeline is worthless. For this investor, the growth potential of Opzelura alone could justify a much higher valuation, and the massive share buyback program provides a powerful catalyst for EPS growth.

For the Conservative or Momentum Investor: This is a stock to approach with caution. The Jakafi patent cliff is a real and significant headwind, and the company's recent track record of pipeline failures is a major concern. This type of investor would likely want to see clear evidence of a successful and accelerating Opzelura launch and some positive late-stage pipeline news before considering an investment.

Incyte Corporation is a company at a major inflection point. It is a proven innovator and a highly profitable business that is facing a classic biotech challenge: diversifying beyond its first major success. If the launch of Opzelura is a blockbuster and the pipeline can deliver just one or two more wins, the current stock price will look like an incredible bargain in hindsight. However, the risks are real, making Incyte a stock best suited for patient, value-oriented investors with a tolerance for the inherent volatility of the biotechnology industry.

This was the Incyte (INCY) Stock: A Biotech Leader at a Deep Value Inflection Point. Want to know which healthcare stocks are part of the S&P 500? Click here.

Four years ago, my husband was diagnosed with IPF (Idiopathic Pulmonary Fibrosis), a moment that changed our lives significantly. For more than two years, he followed his prescribed medications and attended regular medical checkups. Despite this, his symptoms persisted, and we remained concerned about his overall health. He struggled with low energy, frequent discomfort, and the emotional stress that came with ongoing uncertainty.In search of additional support, we decided last year to explore a herbal treatment program offered by NaturePath Herbal Clinic. We approached it cautiously and without high expectations. Over time, however, we began to notice encouraging changes. His tiredness eased, his digestion became more stable, and he appeared stronger and more at ease overall. Little by little, his…