Merck & Company (MRK) Stock: The Titan Facing a Post-KEYTRUDA World

- Aug 27, 2025

- 7 min read

Updated: Aug 29, 2025

In the world of pharmaceuticals, few names command as much respect as Merck & Co. For investors, it has long been seen as a blue-chip stalwart, a reliable generator of profits and dividends anchored by a legacy of scientific innovation. Today, that reputation is largely powered by a single, revolutionary product: the cancer immunotherapy drug KEYTRUDA. Its unprecedented success has fueled incredible growth, making Merck an oncology powerhouse. But this dominance presents a multi-billion-dollar question: What happens next?

For anyone considering an investment in Merck, the central challenge is looking beyond the era of KEYTRUDA. This deep-dive analysis will explore every facet of the company, from its storied past to its current financial strength. We will dissect its blockbuster products, examine its future pipeline, and confront the monumental risk of its upcoming patent cliff. By understanding both the opportunities and the immense pressures facing the company, you can make an informed decision about whether Merck deserves a place in your portfolio.

A Legacy Forged in Science and Public Health

Merck's identity is rooted in a history of tackling some of the world's most challenging diseases. Founded in 1891 as the U.S. subsidiary of a German company, Merck has a long and decorated track record of medical firsts that have shaped global public health. Its culture has always been one of scientific rigor, often prioritizing long-term medical impact.

Key historical milestones that define this legacy include:

1930s-40s: Merck scientists synthesized vitamins B1, B2, B6, and E, making mass production possible and helping to eradicate common nutritional deficiencies. During World War II, the company's researchers developed a method for mass-producing penicillin, saving countless lives.

1950s-60s: The company became a leader in vaccines, developing the first-ever vaccine for mumps in 1967, which was later combined with its measles and rubella vaccines to create the iconic MMR vaccine.

1980s: Merck scientists discovered and developed the first statin drug, Mevacor (lovastatin), to lower cholesterol, a breakthrough that laid the foundation for modern cardiovascular disease prevention.

1987: In a landmark act of corporate philanthropy, Merck committed to donating its revolutionary drug Mectizan (ivermectin) for as long as needed to eliminate river blindness, a parasitic disease that ravaged communities in Africa and Latin America.

This history of transformative R&D is vital for investors to understand. It demonstrates a deeply ingrained capability to produce scientific breakthroughs and a corporate ethos that extends beyond pure profit. This legacy provides a degree of confidence in the company's ability to navigate the scientific challenges that lie ahead.

The Modern Merck: A Tale of Two Pillars

Today, Merck operates through two core business segments: Pharmaceuticals and Animal Health. While one is vastly larger than the other, both contribute to its overall stability and growth profile.

Pharmaceuticals: The Oncology and Vaccine Powerhouse

This segment is the heart of Merck, accounting for nearly 90% of its revenue. It is here that the company develops and sells innovative, patent-protected medicines and vaccines for human health. While the portfolio is broad, its current success is overwhelmingly concentrated in two key areas.

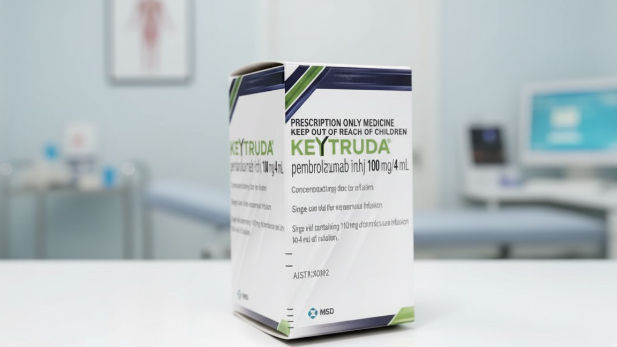

1. KEYTRUDA (pembrolizumab): The Undisputed King of Oncology

It is impossible to overstate the importance of KEYTRUDA to Merck. This revolutionary immunotherapy drug has fundamentally changed cancer treatment. Rather than attacking cancer cells directly, it works by blocking a protein called PD-1, effectively taking the "brakes" off the immune system and allowing it to recognize and kill tumors.

Its success has been nothing short of phenomenal. Approved for an ever-expanding list of more than 30 different types of cancer—from lung cancer and melanoma to bladder and head and neck cancers—KEYTRUDA has become the world's best-selling drug. In 2024 alone, its sales reached a staggering $27.1 billion, accounting for over 40% of Merck's total revenue. The drug's dominance is the primary driver of Merck's recent financial performance and its premium standing in the pharmaceutical industry.

2. The Vaccine Franchise: A Global Health Leader

Merck's second major pillar is its world-class vaccine portfolio, a business that provides durable, long-term revenue streams.

Gardasil/Gardasil 9: This is the company's human papillomavirus (HPV) vaccine, a groundbreaking product that helps protect against several types of cancer, including cervical, anal, and throat cancers. As global vaccination rates increase, Gardasil has become a multi-billion-dollar blockbuster in its own right, with 2024 sales of $9.1 billion.

Vaxneuvance & Pneumovax 23: These pneumococcal vaccines are critical tools in preventing pneumonia and other serious infections, particularly in children and the elderly.

ProQuad/MMR-II & Varivax: These are the foundational childhood vaccines for measles, mumps, rubella, and chickenpox, making Merck an indispensable partner in pediatric public health.

Animal Health: A Stable and Growing Business

Merck's Animal Health division is a global leader in veterinary medicine, providing a wide range of vaccines, pharmaceuticals, and technology solutions for both livestock and companion animals. Its portfolio includes the highly successful Bravecto line of flea and tick products for pets.

While much smaller than the pharmaceutical segment, this business is a vital part of the investment thesis. It provides valuable diversification, with steady, reliable growth that is less dependent on the boom-and-bust cycle of drug patents. In 2024, the Animal Health segment generated $6.1 billion in revenue, growing at a solid 5% clip.

Financials and Shareholder Returns

Merck's financial performance reflects its blockbuster-driven success. In 2024, the company reported total revenues of $63.9 billion, a healthy 7% increase year-over-year. This growth was powered almost entirely by KEYTRUDA and Gardasil. Looking ahead, the company has guided for continued strong growth, projecting 2025 revenues to reach between $67.4 and $68.9 billion.

A key part of Merck's appeal, especially for more conservative investors, is its commitment to shareholder returns through a consistent and growing dividend.

Dividend Yield: Merck typically offers an attractive dividend yield, often in the range of 2.5% to 3.0%, making it a solid choice for income-focused portfolios.

Dividend Growth: The company has a strong track record of increasing its dividend, with an average annual growth rate of over 8% in recent years. This demonstrates management's confidence in future cash flows.

Share Repurchases: In addition to dividends, Merck actively returns capital to shareholders through stock buyback programs, which can help support the stock price over time.

This disciplined approach to capital allocation makes Merck a classic blue-chip investment: a company that balances reinvestment for future growth with direct returns to its owners.

The Challenge Ahead: Life After the KEYTRUDA Patent Cliff

For all its success, Merck is facing one of the largest patent cliffs in pharmaceutical history. The main patents protecting KEYTRUDA from generic competition are set to expire in 2028. When that happens, the company stands to lose exclusivity on a drug that currently generates over 40% of its sales.

This is the single most important risk for any potential Merck investor. The company's management is in a race against time to develop and acquire new products that can fill the enormous revenue gap that KEYTRUDA will eventually leave behind. The success or failure of this effort will determine the company's trajectory for the next decade.

Analyzing the R&D Pipeline

Merck is investing heavily in its pipeline to prepare for the post-2028 world. Its strategy is focused on several key areas:

Oncology Beyond KEYTRUDA: Merck is developing next-generation cancer drugs, including antibody-drug conjugates (ADCs), which are like "smart bombs" that deliver chemotherapy directly to cancer cells. It is also exploring combination therapies, pairing KEYTRUDA with other drugs to improve its effectiveness.

Vaccines: The company is working on an investigational vaccine for dengue fever and a next-generation pneumococcal vaccine to expand its dominance in this area.

Cardiovascular Disease: The centerpiece of this strategy was the $11.5 billion acquisition of Acceleron Pharma. This deal brought sotatercept, a promising new drug for treating pulmonary arterial hypertension (PAH), a rare and life-threatening blood vessel disorder. Sotatercept has shown impressive clinical data and has the potential to be a multi-billion-dollar blockbuster, providing a much-needed source of diversified growth.

Other Areas: The pipeline also includes candidates in infectious diseases, neuroscience, and immunology.

The key question for investors is whether this collection of assets, promising as some may be, can collectively replace the revenue of a single mega-blockbuster like KEYTRUDA.

Fundamental Data

Go beyond the stock price with this deep dive into a company's core fundamentals.

🔖 Key Takeaways

The decision to invest in Merck is fundamentally a bet on its ability to successfully manage the transition to a post-KEYTRUDA world. Your investment approach should align with your view on this central challenge.

For the Value- and Income-Oriented Investor: Merck presents a compelling case. You get to own a best-in-class company with dominant products, generating enormous free cash flow today. The reliable and growing dividend provides a solid return while you wait for the pipeline to develop. For this investor, the market's anxiety about the 2028 patent cliff may present an opportunity to buy a high-quality company at a reasonable valuation.

For the Growth-Focused Investor: The picture is less certain. While assets like sotatercept and its ADC programs offer significant growth potential, it will be incredibly difficult to replicate the explosive growth that KEYTRUDA has delivered. This investor must have strong faith in management's ability to execute on its pipeline and M&A strategy. The risk of slower growth or pipeline failures after 2028 is substantial.

Ultimately, Merck is a world-class company facing a once-in-a-generation challenge. It has the financial resources, the scientific talent, and a clear strategy to prepare for the future. Whether that will be enough to fill the void left by one of the most successful drugs in history remains the defining question that will drive its stock for years to come.

Want to know how healthcare professionals can earn more money outside the hospital? Click here.

Four years ago, my husband was diagnosed with IPF (Idiopathic Pulmonary Fibrosis), a moment that changed our lives significantly. For more than two years, he followed his prescribed medications and attended regular medical checkups. Despite this, his symptoms persisted, and we remained concerned about his overall health. He struggled with low energy, frequent discomfort, and the emotional stress that came with ongoing uncertainty.In search of additional support, we decided last year to explore a herbal treatment program offered by NaturePath Herbal Clinic. We approached it cautiously and without high expectations. Over time, however, we began to notice encouraging changes. His tiredness eased, his digestion became more stable, and he appeared stronger and more at ease overall. Little by little, his…