NYC Medical Debt Relief Program Launches Financial Empowerment Centers After Canceling $135M in Debt

- Oct 27, 2025

- 3 min read

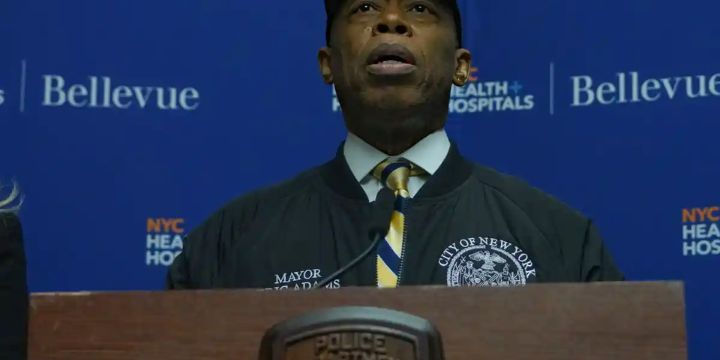

New York City has taken a commanding lead in tackling healthcare affordability, with Mayor Eric Adams announcing the cancellation of nearly $135 million in medical debt for over 75,000 residents. This massive intervention was a key commitment laid out in the Mayor's State of the City address last year, and it is part of a wider initiative aimed at eliminating $2 billion in debt for approximately 500,000 patients. The current relief effort stems from a three-year, $18 million investment launched by the city, working in partnership with the nonprofit organization Undue Medical Debt. This program functions by acquiring qualifying medical debt portfolios, often at "pennies on the dollar," and then erasing the debt, ensuring recipients owe nothing and face no tax penalty. Residents who qualify for this one-time relief are automatically notified by Undue Medical Debt.

Eligibility for the NYC Medical Debt Relief program is based on financial need, requiring that the New Yorker’s debt has been acquired and that they meet one of two criteria: having an annual household income at or below 400% of the Federal Poverty Line, or having medical debt equal to 5% or more of their annual household income. Mayor Adams stressed that for too long, medical debt has acted as a barrier to receiving necessary health care and served as a major financial and emotional stressor for families. Financial experts agree that carrying medical debt can severely undermine financial stability by negatively affecting credit scores. Michelle Morse, M.D., NYC Department of Health and Mental Hygiene acting commissioner, highlighted that eliminating medical debt is a necessity, as many New Yorkers are forced to choose between their health and basic needs like food or housing. By providing this relief, the city is granting residents the freedom to prioritize their health and making the city more accessible.

Crucially, the initiative extends beyond simply erasing existing debt; it focuses on Financial Empowerment to prevent future crises. The city announced the opening of eight new financial empowerment centers at select NYC Health + Hospitals locations across the Bronx, Brooklyn, Manhattan, and Queens. These centers offer free, one-on-one counseling and coaching services designed to support long-term financial planning, debt management, and credit repair. Locations include NYC Health + Hospitals/Bellevue, Jacobi, Kings County, and Elmhurst, among others. These additions expand the city’s resources, which now include more than 40 financial centers.

While New York City advances its local Public Health and financial stability agenda, other parts of the country face ongoing challenges in the healthcare landscape. In Florida, the CEO of the Florida Hospital Association, Mary Mayhew, detailed the increasingly uncertain financial struggles of rural hospitals, using DeSoto Memorial Hospital as a poignant example. Across the USF Tampa area, a study revealed that levels of PFAS, often called "forever chemicals," in the municipal drinking water supplies were six times higher than the recommended limits set by the Environmental Protection Agency, raising significant environmental health concerns. Meanwhile, regulatory approaches vary greatly; Idaho recently passed legislation—hailed by activists as the first true “medical freedom” bill—that effectively bans vaccine mandates, chipping away at traditional public health foundations. Conversely, the Kane County Health Department in Illinois launched an education campaign to ensure residents have access to "clear, trustworthy information" regarding vaccines and respiratory illnesses. Finally, relief efforts faced setbacks when Maryland Governor Wes Moore criticized FEMA's denial of federal disaster relief following flooding in May, calling the agency’s decision "deeply frustrating" and stating it "leaves Marylanders on their own".ss, financial stability, and environmental safety.

Comments